The Pulse of Private Equity – 7/3/2017

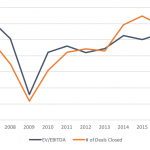

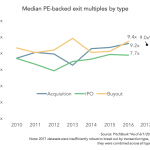

Global PE Buyout Multiples and Deal Flow View PitchBook’s 2017 Analyst Note: Where can PE firms find attractive valuations? Here Global buyout activity has gradually surpassed median EBITDA levels following the financial crisis. Creeping up to 10.2x on the eve of the crisis, LBO valuations have oscillated in the 8x-9x range dating back to 2010,…