Leveraged Loan Insight & Analysis – 8/7/2017

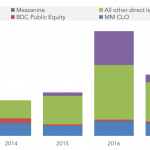

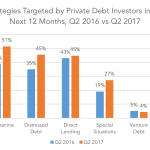

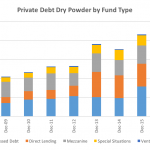

MM Fundraising hits US$35B YTD, on track to match 2016 levels Fundraising for middle market lending continues strong in 2017. Year to date LPC has tracked almost US$35 billion in inflows on the back of US$60B just last year. Direct lending funds continue to make up the biggest piece of the pie raking in 64%…