The Pulse of Private Equity – 9/3/2018

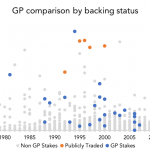

GP stakes investing—a new trend emerging? Download PitchBook’s Report here. TPG Capital, one of the largest PE firms to retain its partnership structure, flirted with the idea of going public this year. Many of its peers are already publicly traded—Blackstone, KKR and Apollo, to name a few. But since going public, their shares haven’t performed very…