The Pulse of Private Equity – 5/15/2017

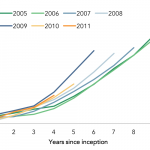

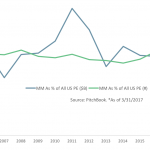

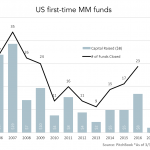

Cyclicality of PE industry coming to bear? View PitchBook’s 2017 Global PE & VC Fund Benchmarking Report: Part II Here From the rhythmic ebb and flow of the tide to the mysterious circadian patterns within each human, the world is governed by cycles. When it comes to private equity investment and fundraising, multiple separate cycles…