Private Debt Intelligence – 5/22/2017

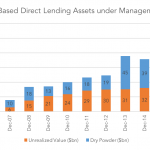

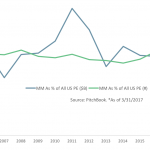

US Direct Lending Funds Approach $100bn in AUM The direct lending market in the US has been growing consistently since the Global Financial Crisis (GFC). Given the long-term low-interest environment, many investors have been looking for alternatives to supplement their fixed income investments, which have seen yields remain low. Direct lending, in this context,… Login