Private Debt Intelligence – 8/9/2021

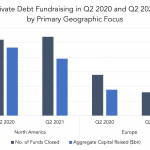

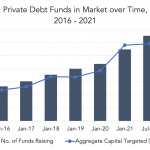

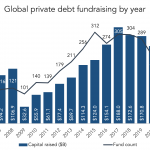

Europe outraises North America in Q2 Globally, both the number of private debt funds in market and the amount of capital targeted continued to rise through Q2 2021. North America-focused funds saw the largest number of closes over Q2 2021, with 27 funds compared to Europe’s eight…. Subscribe to Read MoreAlready a member? Log in