Leveraged Loan Insight & Analysis – 5/11/2020

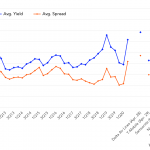

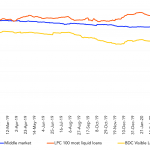

Pricing, OIDs also widen for double B issuers in today’s market Pricing for double-B rated issuers has widened significantly this quarter. The average yield, assuming a three-year term to repayment, on first-lien institutional term loans for BB rated issuers is 6.19% so far this quarter, up from a much lower average of 3.94% in 1Q20….