PDI Picks – 4/19/2021

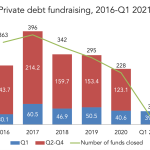

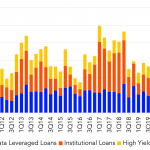

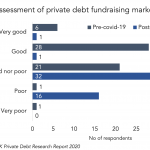

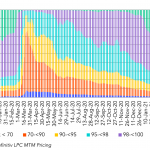

Fundraising still lagging – for now Private debt fund managers are still struggling to attract investor commitments, but the asset class looks well placed going forward. The numbers are in – and provide disappointment for anyone hoping for a rapid turnaround in the fortunes of private debt fundraising. As can be seen from the chart…