Private Debt Intelligence – 12/16/2019

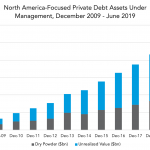

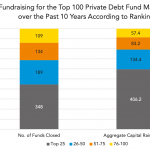

North America Private Debt Set to Hit $500bn The North America-focused private debt market has seen a slowdown in 2019. As of December, 58 funds focused on the region had closed, raising a combined $40bn. This is significantly down from the 118 funds that secured $74bn in 2018, and is the lowest fundraising year since…