PDI Picks – 2/22/2021

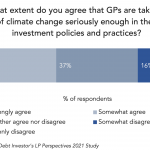

The climate change debate heats up Private debt managers have not been at the forefront of ESG in the past but times are changing. When we canvassed the opinions of limited partners about how seriously private debt fund managers take climate change, the responses were not exactly a ringing endorsement. Just 4 percent told our…