PDI Picks – 10/21/2019

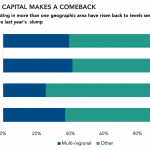

Multi-regional funds hold their own in chase for capital In 2019, so far, capital pools investing in more than one global region have raised more than in 2018. Multi-regional funds – those investing across more than one geographic area – have made a comeback this year, or at least risen back in line to prior…