PDI Picks – 9/30/2019

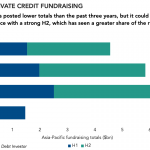

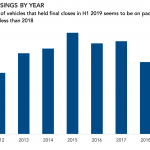

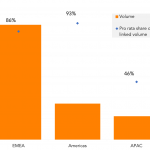

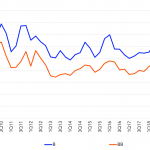

Asian credit fundraising is a drag A dip in H1 2019 private debt fundraising numbers doesn’t mean the year’s total will finish less than prior years, as the second half of the year is typically stronger than the first. Capital raising in the Asia-Pacific region has lagged in the first half of the year, pulling…