PDI Picks – 9/16/2019

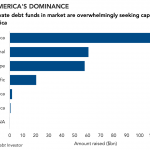

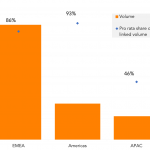

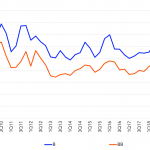

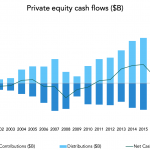

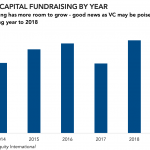

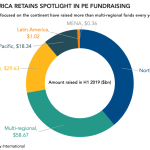

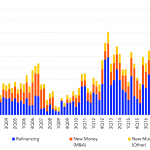

North America ascendant in rat race for capital Many smaller private debt funds may be targeting the continent, but that is at odds with the trend toward more capital in the hands of fewer managers. North America may be rising in private credit fundraising – funds targeting the continent are seeking $116.6 billion. Funds investing…