Leveraged Loan Insight & Analysis – 8/12/2019

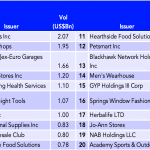

Top US CLO retail holdings Top retail loan holdings in active US CLOs at the end of July include Albertson’s TLB, Bass Pro Shops TL and EG Group TL, with US$2.1bn, US$1.9bn and US$1.7bn of total issuer loan volume respectively. While loan debt of several defaulted retail issuers is still held in active CLOs, their…