PDI Picks – 7/22/2019

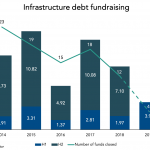

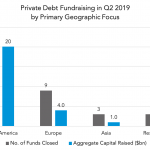

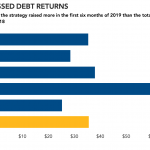

An energy boost for infrastructure debt The strategy has plenty of supporters in the investor community, as the latest PDI fundraising figures demonstrate. Private debt fundraising is going strong – but, proportionally, infrastructure debt fundraising is going even stronger. In our recently released global fundraising figures for the first half of this year, PDI revealed…