Leveraged Loan Insight & Analysis – 7/8/2019

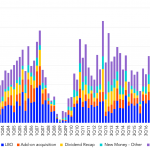

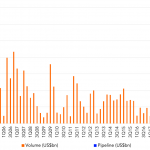

Syndicated MM sponsored lending volume reached $13.6bn in 2Q19 Syndicated middle market sponsored lending volume improved somewhat in the second quarter, but not nearly enough to match 2017-2018 levels. Issuance grew 10% quarter over quarter to US$13.61bn in 2Q19, but was still over 40% lower than 2Q18 levels. The lack of refinancing actvity was the…