Leveraged Loan Insight & Analysis – 7/1/2019

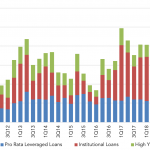

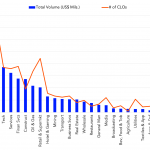

1H19 Leveraged lending down 44% y-o-y; Leveraged loan volume off 53% Renewed focus on credit quality and increased market volatility combined gave rise to increased selectivity among leveraged loan investors, despite a lighter 2Q19 deals calendar. At US$255.35bn, 2Q19 total leveraged lending was up slightly compared to 1Q19 results but down 45% compared to the…