The Pulse of Private Equity – 6/10/2019

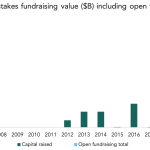

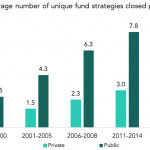

GP stakes fundraising starting to boom Download PitchBook’s Report here. An awaited flood of GP stakes fundraising is starting to take shape. The funds currently in the market will eventually amass more capital for the strategy than the past decade combined, according to our recently released analyst note. The majority of those raises will be housed…