PDI Picks – 5/13/2019

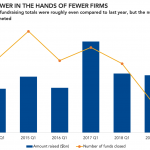

When junior debt fundraising comes out on top The lack of mid-market mezzanine opportunities has likely caused the size of mezzanine funds to grow faster than senior debt vehicles. Fewer firms are raising a greater portion of all private debt capital, but this stands out to be particularly true in mezzanine debt. Junior loan funds…