Leveraged Loan Insight & Analysis – 2/1/2021

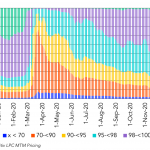

Loan fund AUM continues to grow amid large inflows in January U.S. CLO AUM ended January at $747bn, up 10.3% YoY, with 17 new U.S. CLOs totaling $8.5bn pricing last month. It was the highest January volume since 2013 and included 4 deals with a total size over $600m. Despite the pandemic, CLO AUM has…