PDI Picks – 9/7/2020

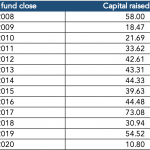

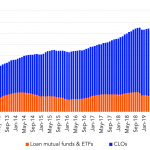

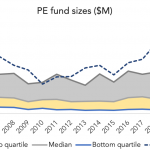

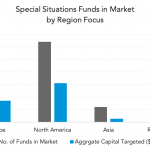

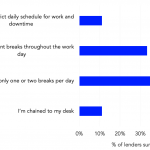

Less for distress The coronavirus crisis may have been expected to lead to a fundraising surge for troubled companies. But investors are wary of making bad moves. Investors may be convinced of the intellectual case for changing their private credit allocations in reaction to the coronavirus crisis and its huge policy response. However, this crisis…