PDI Picks – 9/14/2020

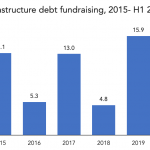

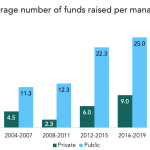

Infrastructure debt’s strong foundations It’s an investment option that’s become big in Japan, but strong competition for deals casts a cloud. Infrastructure debt continues to attract interest from long-term investors. As can be seen from the chart above, fundraising reached a five-year peak in 2019 and was also strong at the beginning of this year…