Private Debt Intelligence – 4/15/2019

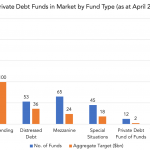

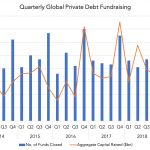

Private Debt Funds in Market The private debt fundraising marketplace is becoming increasingly crowded: as of the start of April 2019, there are 407 vehicles seeking a total of $182bn from investors. These figures have continued to increase from the 395 funds seeking $168bn at the start of the year to reach a new record…