Middle Market & Private Credit – 4/1/2024

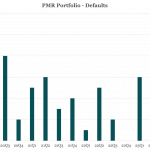

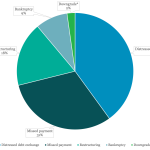

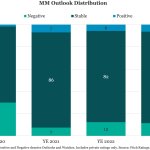

Rising Payment-in-Kind Trends in Private Credit Will Have a Mixed Impact Interests paid-in-kind (PIK) are likely to rise among private middle-market loans in the US through both amendments to existing loans and as an optionality in new loan originations, as the impact of higher rates fully kicks in and credit burden builds up among borrowers….