Markit Recap – 8/13/2018

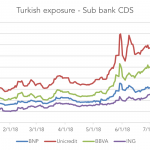

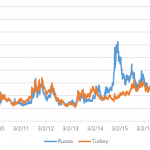

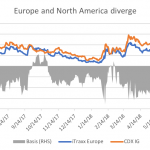

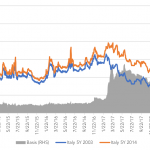

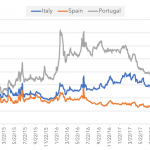

Turkey’s self-inflicted problems have had ramifications well beyond its borders and led to comparisons with previous emerging market crises. Mexico in 1994; south-east Asia in 1997; Russia in 1998; Argentina in 2001: all have been invoked as precursors to Turkey’s seemingly inevitable descent into debt distress and recession…. Subscribe to Read MoreAlready a member?