The Pulse of Private Equity – 9/18/2023

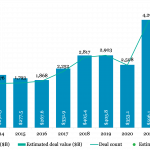

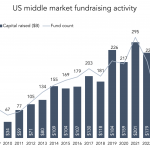

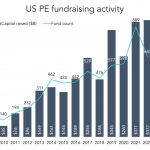

Middle market deal activity Download PitchBook’s Report here. The middle market is humming along, according to PitchBook’s latest US PE Middle Market Report. Through June, about $214 billion has been invested across 1,635 deals. Both figures are slightly under last year’s pace but still ahead of the pre-COVID years. Middle market companies are being wooed by…