The Pulse of Private Equity – 7/18/2022

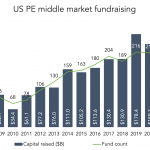

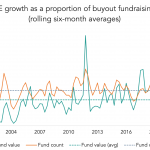

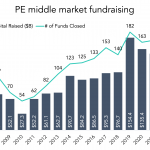

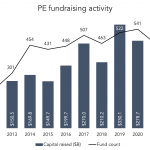

A tricky fundraising trail Download PitchBook’s Report here. PE fundraising is slowing, according to PitchBook’s latest US PE Breakdown, as a whole and in the middle market. For the past three years, the middle market has raised at least $150 billion, but that might not stretch to a fourth consecutive year. $71.3 billion has been raised…