The Pulse of Private Equity – 4/5/2021

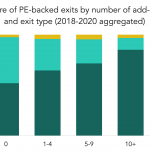

Buy-and-build correlates to more secondary buyouts PitchBook is publishing a new analyst note next week that does a deep dive on add-ons. One of the more striking findings is a correlation between additive platforms and how they eventually exit. The more add-ons a portfolio company undergoes, the more likely it will be acquired by another…