The Pulse of Private Equity – 2/25/2019

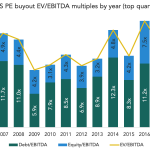

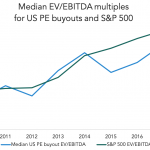

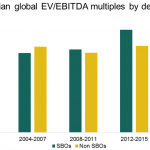

Downturn opportunities don’t last long Bain & Company released its annual private equity report this week. It’s required reading for the industry every year. One of their more salient points is the resiliency of purchase price multiples following downturns. In the two-year window between 2009 and 2011,… Subscribe to Read MoreAlready a member? Log in