The Pulse of Private Equity – 6/19/2017

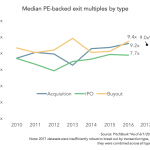

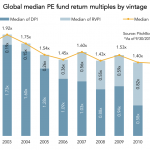

Exit multiples have stayed steady at an elevated level View PitchBook’s 2017 PE & VC Exits Here Slowly but surely, exit multiples for secondary buyouts and corporate acquisitions have risen over the past two years, with figures for the former topping off at 9.4x last year. Thus far in 2017, the aggregate figure for all transaction…