Private Debt Intelligence – 7/12/2021

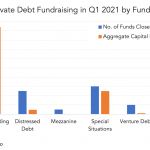

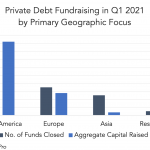

Direct lending remains popular in private debt As governments scale back pandemic support measures and interest rates remain low, private debt strategies are increasingly attractive. Over Q2 2021, direct lending attracted the most interest from investors, closing 17 funds and raising $19bn in commitments…. Subscribe to Read MoreAlready a member? Log in here...