Private Debt Intelligence – 11/30/2020

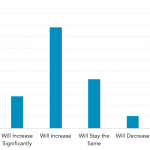

Investors Plans for Their Allocation to Private Debt by 2025 In August 2020, Preqin ran a survey among investors to know their investment plans towards 2025. Of the private debt investors surveyed, 58% intend to increase allocations to the asset class by 2025, 14% of them plan to increase significantly their allocations…. Login to Read