Private Debt Intelligence – 9/14/2020

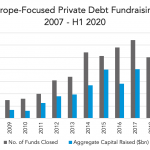

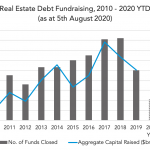

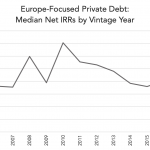

Europe-Focused Private Debt Fundraising Private debt fundraising in Europe has continued to grow at a good pace over 2020 and amid the COVID-19 outbreak, it was relatively strong over the first half of 2020. In H1 2020, the 30 funds closed secured an aggregate $23.5bn in commitments – just under half the amount raised over…