Private Debt Intelligence – 6/22/2020

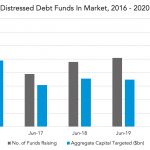

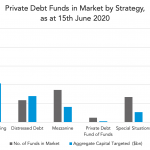

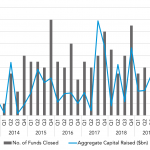

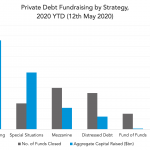

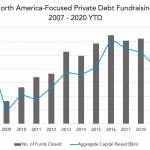

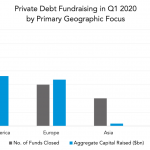

Distressed Debt Funds are on the Raise The private debt market is very crowded and, although direct lending funds represent the largest proportion, distressed debt funds have reached new records. There are currently 60 distressed debt funds in market looking to raise capital, seeking for a combined $72bn in capital…. Login to Read More...