Private Debt Intelligence – 4/13/2020

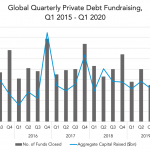

Private Debt Fundraising Falls in Q1 2020 The past quarter has been a challenging one, with the emergence of the COVID-19 pandemic impacting in all markets across the globe. Fundraising in private debt slumped substantially over the first quarter of 2020…. Subscribe to Read MoreAlready a member? Log in here...