Private Debt Intelligence – 2/3/2020

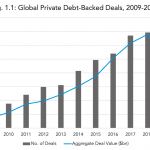

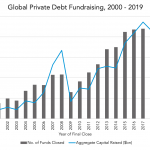

Private Debt Deals Break New Ground Leverage is a key component in a private equity transaction, used to drive and maximize returns for investors. Banks moving away from the space has opened up more and more opportunity for private lenders, which are better positioned to provide an alternative financing model for borrowers…. Subscribe to Read