PDI Picks – 9/6/2021

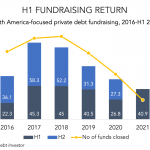

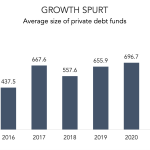

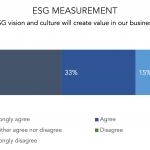

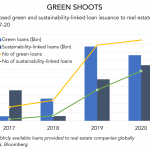

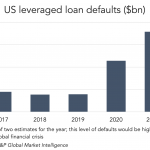

The US market is ‘white hot’ The world’s most mature private debt market is a hive of activity as it shakes off the effects of the health crisis. More than 12 months on from the pandemic-induced slump in sentiment, the US private debt market is in rude health – “white hot and hotter than it…