PDI Picks – 2/24/2020

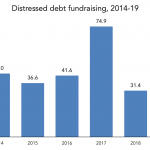

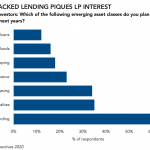

Distress is back in fashion Amid a subdued year for private debt fundraising in 2019, distressed debt proved to be a magnet for investors. Last year saw the lowest level of private debt fundraising since 2014, indicating that the asset class may be losing some of its sheen – or that investors are taking a…