PDI Picks – 11/25/2019

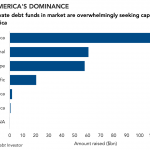

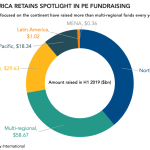

North America’s dominance shows in 15 largest global investors The biggest backers of the asset class generally reside in the world’s largest and most sophisticated alternative credit market. The top half of our inaugural Global Investor 30 rankings shows a worldwide embrace of the asset class, though there is a bias towards North America…. Login