PDI Picks – 9/2/2019

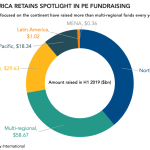

North America tops PE fundraising yet again Despite a global maturation of the asset class, North America still remains the place to be. Private equity has grown globally in recent years, with maturing markets in both Europe and Asia-Pacific, but North America remains the dominant force it has been for years. In the first half…