PDI Picks – 3/8/2021

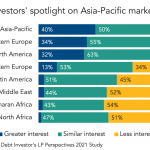

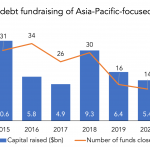

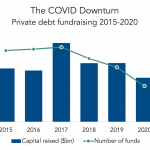

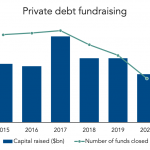

The allure of Asia Pacific Investors have set their sights on the region, perhaps noting the tightness of the documentation. Past research by Private Debt Investor has found Asia Pacific only accounting for around 5 percent of global private debt fundraising, with capital committed to the region a drop in the ocean compared with North…