Leveraged Loan Insight & Analysis – 10/25/2021

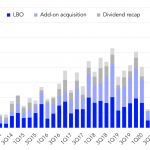

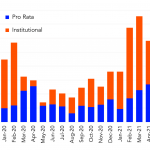

Middle market LBO direct lending surges to new heights It was a record setting quarter for middle market LBO direct lending in 3Q21, with volume surging to US$16.3bn, nearly double the 2Q21 level and 50% above the prior record set in 4Q20. On a year-to-date basis, the US$33.9bn of middle market direct lending LBO volume…