Leveraged Loan Insight & Analysis – 6/13/2016

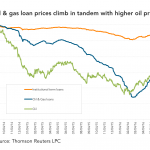

Secondary market oil and gas loan prices have continued to climb recently in tandem with higher oil prices. Oil and gas loans are now up over 16 points from their February low, though their average bid is still a relatively low 70 cents on the dollar. There is also a wide variation in prices across…