Leveraged Loan Insight & Analysis – 8/4/2014

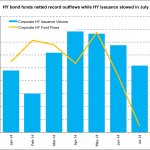

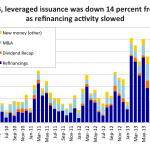

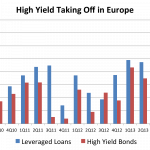

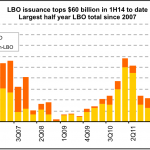

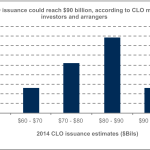

After a record-breaking 2Q14, there was a sharp pull-back in the HY bond market in July. In fact, a number of deals remain on the calendar because they didn’t make it into the market the last week of July due to adverse market conditions…. Login to Read More...