Leveraged Loan Insight & Analysis – 7/3/2023

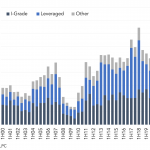

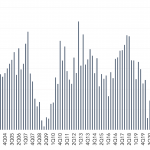

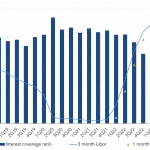

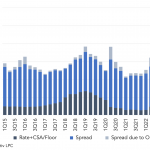

1H23 U.S. loan volume down 18% y-o-y; 2Q23 totals down 32% y-o-y Bruising market volatility marked by higher interest rates, increased regulatory scrutiny of large corporate M&A deals and lender expectations of greater regulatory oversight among reigonal banks contributed to a significant slow down in the 1H23 US BSL market. Roughly US$571bn of issuance was…