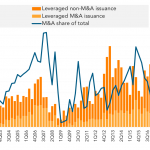

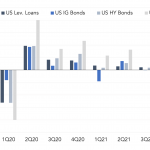

As we discussed last week, the maturity walls don’t sit still either. They act like sand waves marching towards the beach, propelled by the tidal forces of refinanced loans. What looks like imposing cliffs, eventually smooth out over time, eroded by the steady flow of capital into leveraged lending.

We predict that the dynamics driving private credit investing will have a salutary effect on leveraged loan volatility, including the predictability of maturity walls. Next week we’ll compare today’s outlook with how markets came to worry about loan repayments in the first place…

(Any “forward-looking” information may include, among other things, projections, forecasts, estimates of market returns, and proposed or expected portfolio composition Past performance is no guarantee of future results. Investing involves risk; principal loss is possible.)

▶︎ Read February 12th 2024 Newsletter: here