Featuring Charts

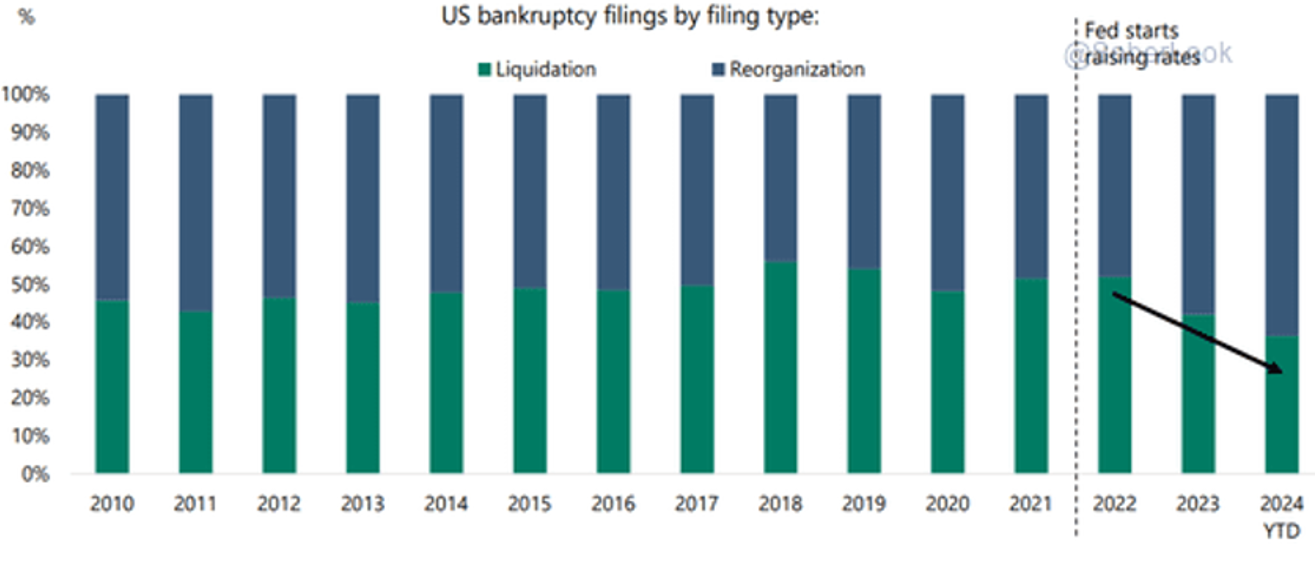

Chart of the Week: Reorg, Don’t Liquidate

Since the Fed’s rate hike regime began, more bankruptcies are reorganizations. Source: Torsten Slok – Apollo, The Daily Shot(Past performance is no guarantee of future results.)

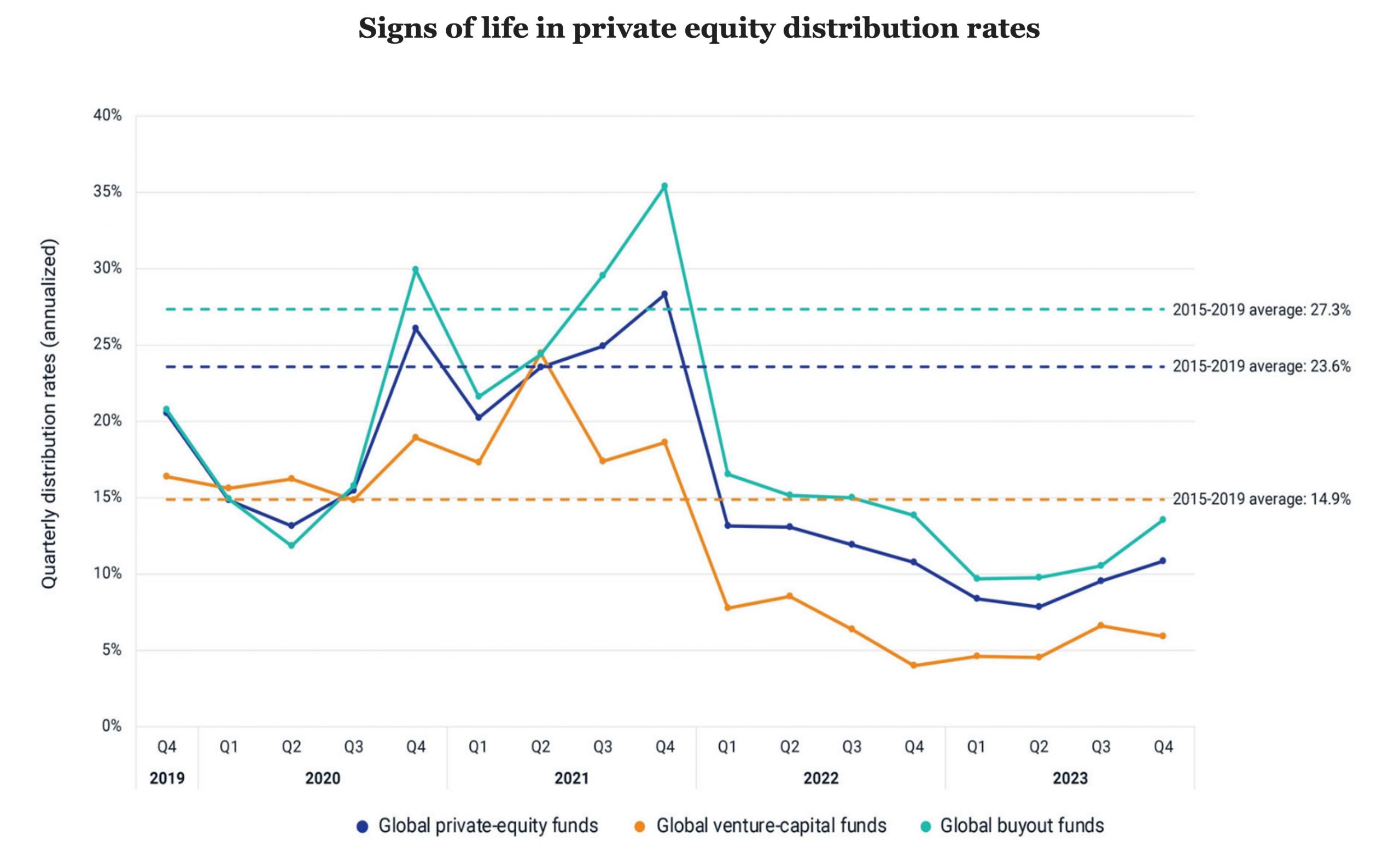

Read MoreChart of the Week: Returns Department

Global private fund returns of capital has begun to improve since early 2023. Source: MSCI – Private Assets in Focus(Past performance is no guarantee of future results.)

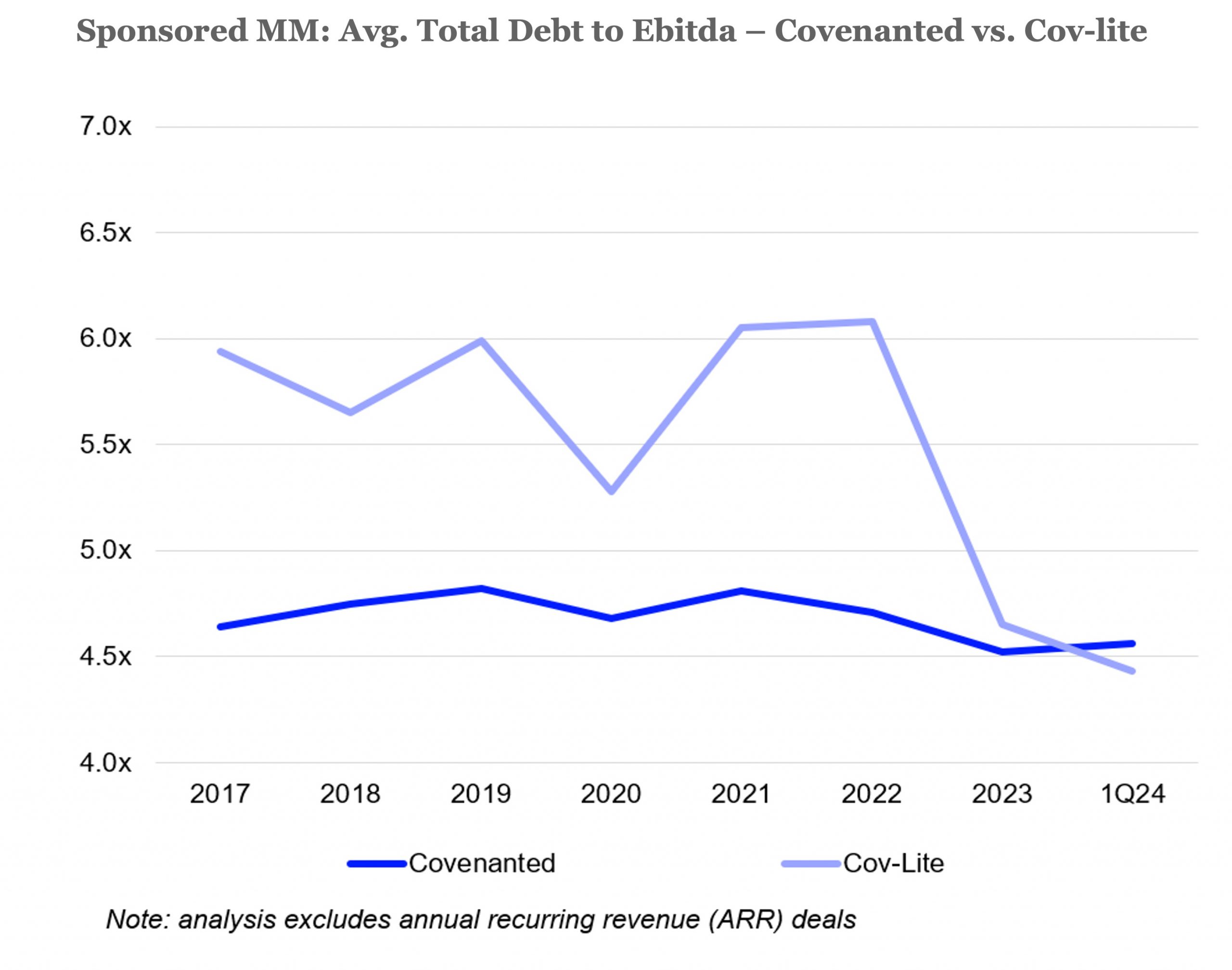

Read MoreChart of the Week: Common Ground

Higher for longer has compressed leverage for both cov-lite and cov-heavy loans. Source: LSEG LPC(Past performance is no guarantee of future results.)

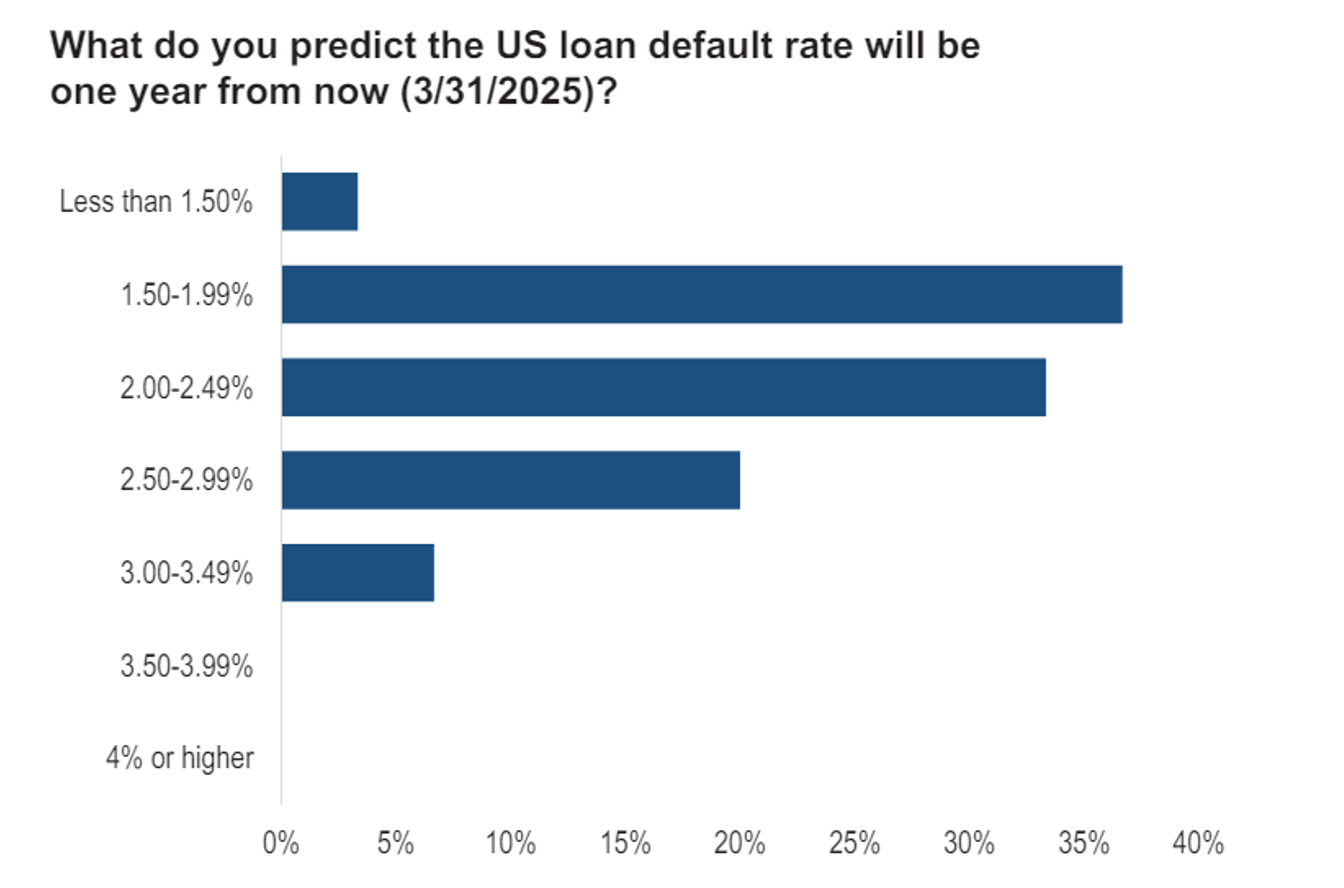

Read MoreChart of the Week: Rate Expectations

Loan participants see higher defaults from 1.6% today, but not much higher. Source: PitchBook/LCD(Past performance is no guarantee of future results.)

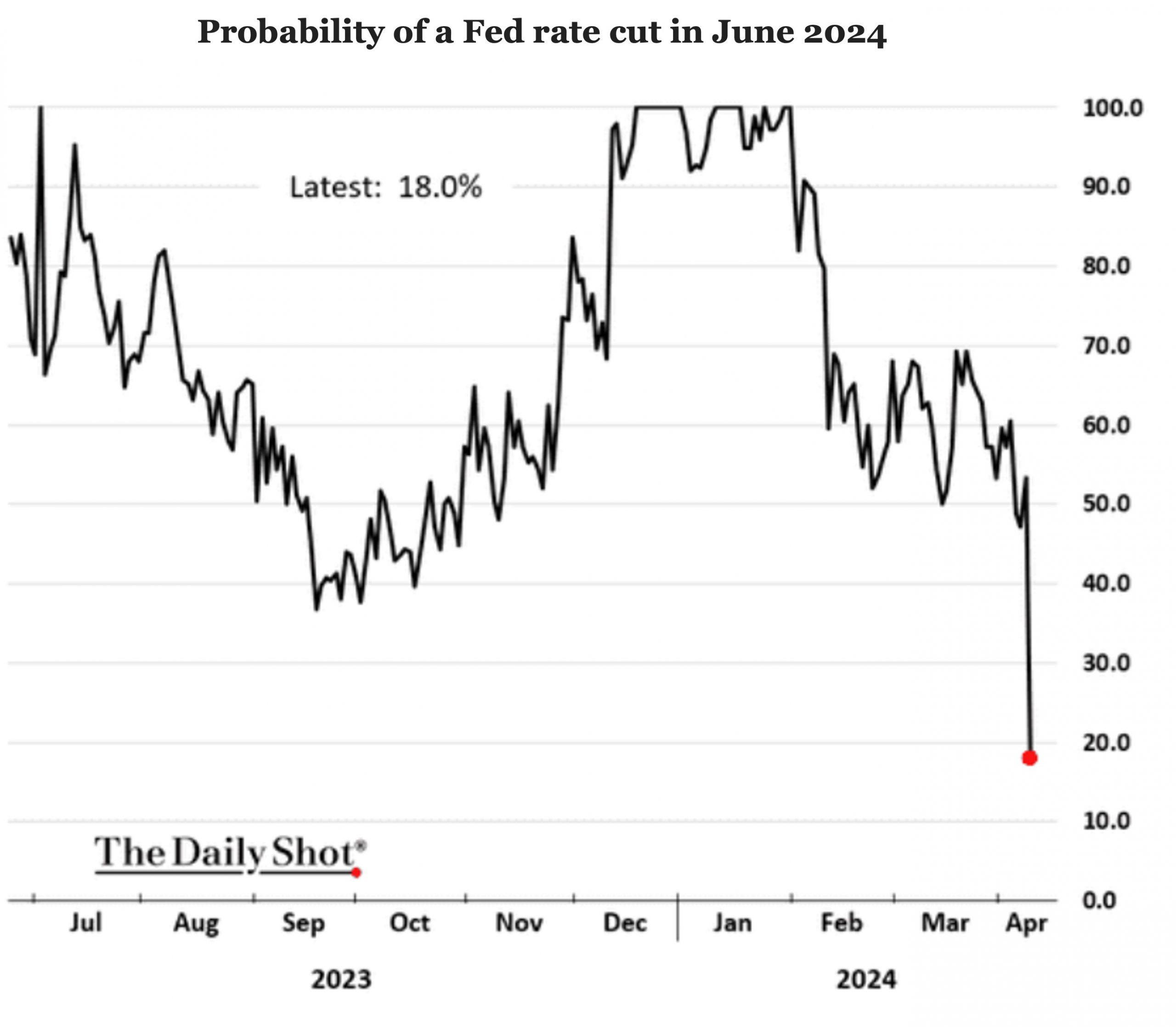

Read MoreChart of the Week: No Ifs, Ands, or Cuts

Market observers now think a rate cut at the Fed’s June meeting is unlikely. Source: The Daily Shot(Past performance is no guarantee of future results.)

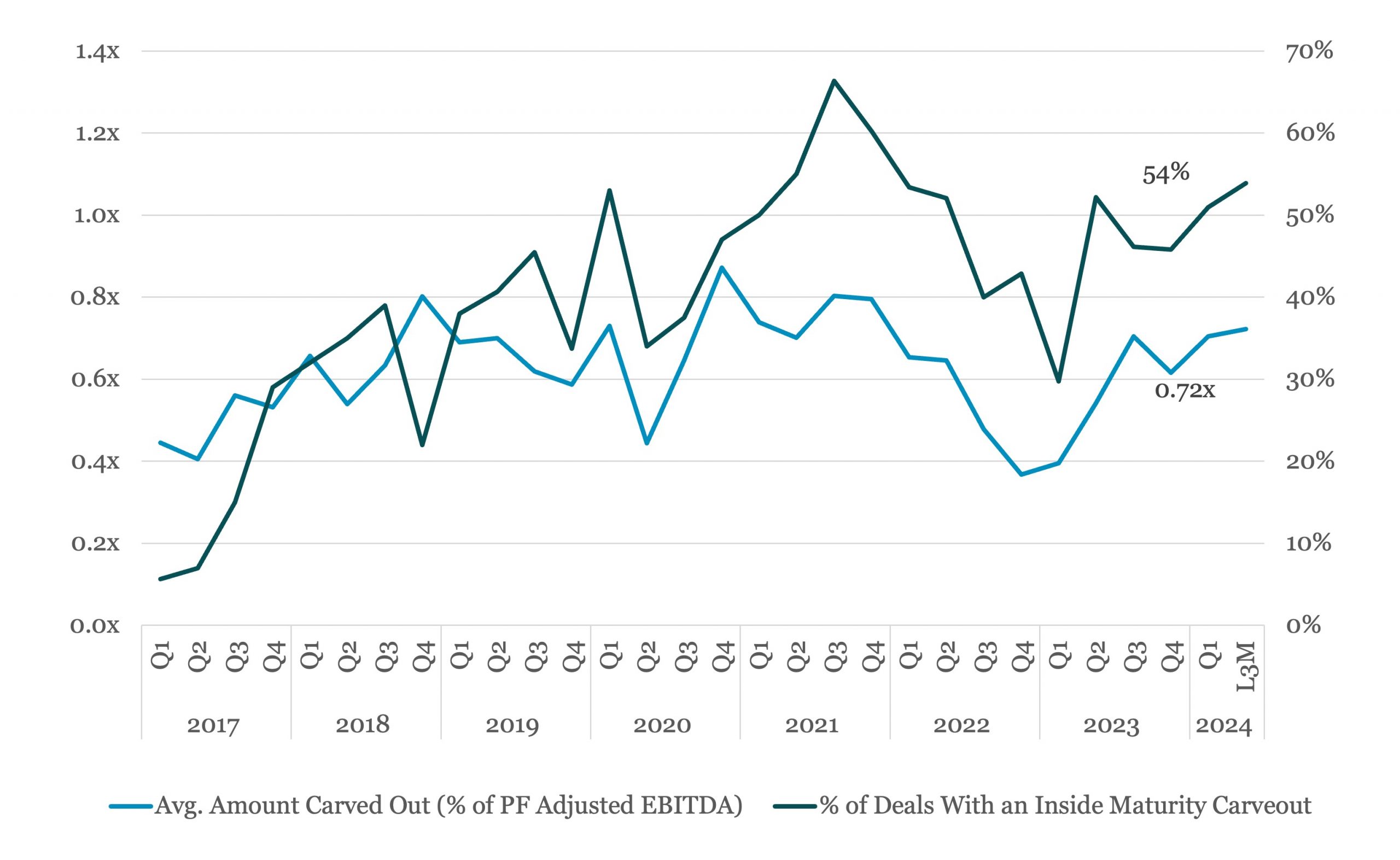

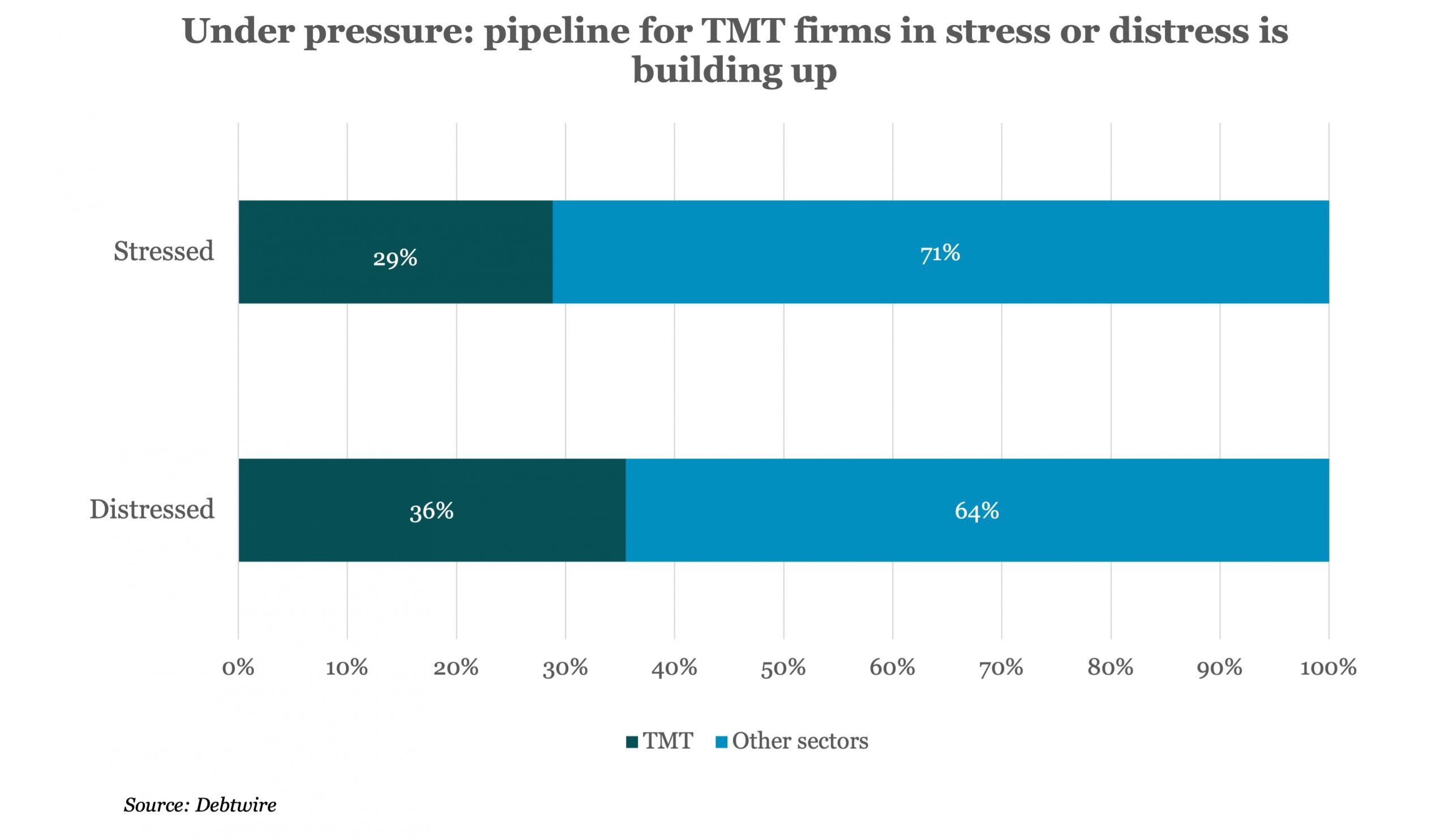

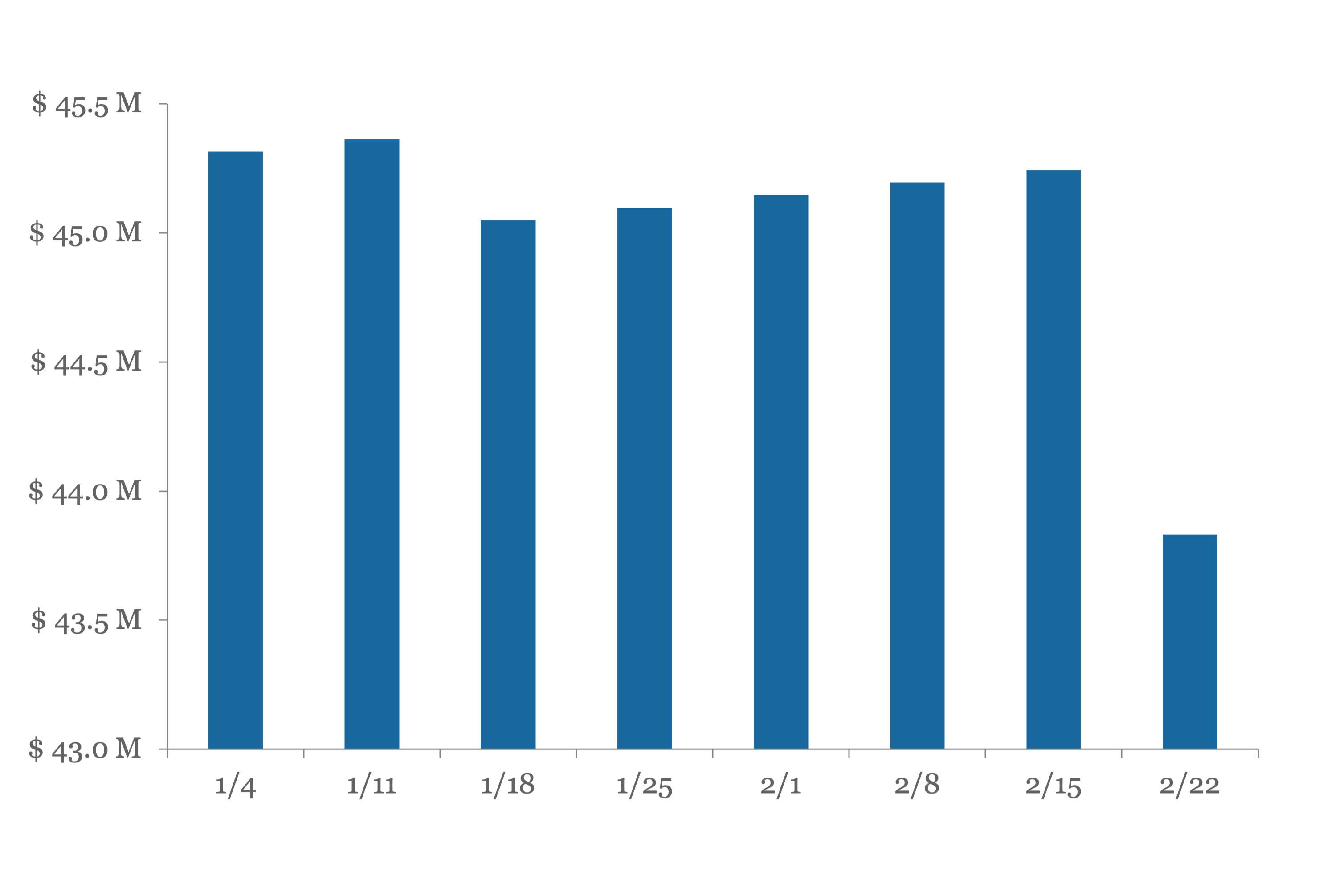

Read MoreChart of the Week: Honey, I Shrunk the Interest Coverage Cushions

The Fed’s “higher-for-longer” has compressed leverage loan coverage ratios. Source: PitchBook | LCD(Past performance is no guarantee of future results.)

Read MoreSubscribe Now!

Join the leading voice of the middle market. Try us free for 30 days.

Click here to view the Newsletter sample.

What is the Lead Left?

- One-stop source for deals and data

- Market trend commentary and analysis

- Exclusive interviews with thought leaders

View Article By

Features

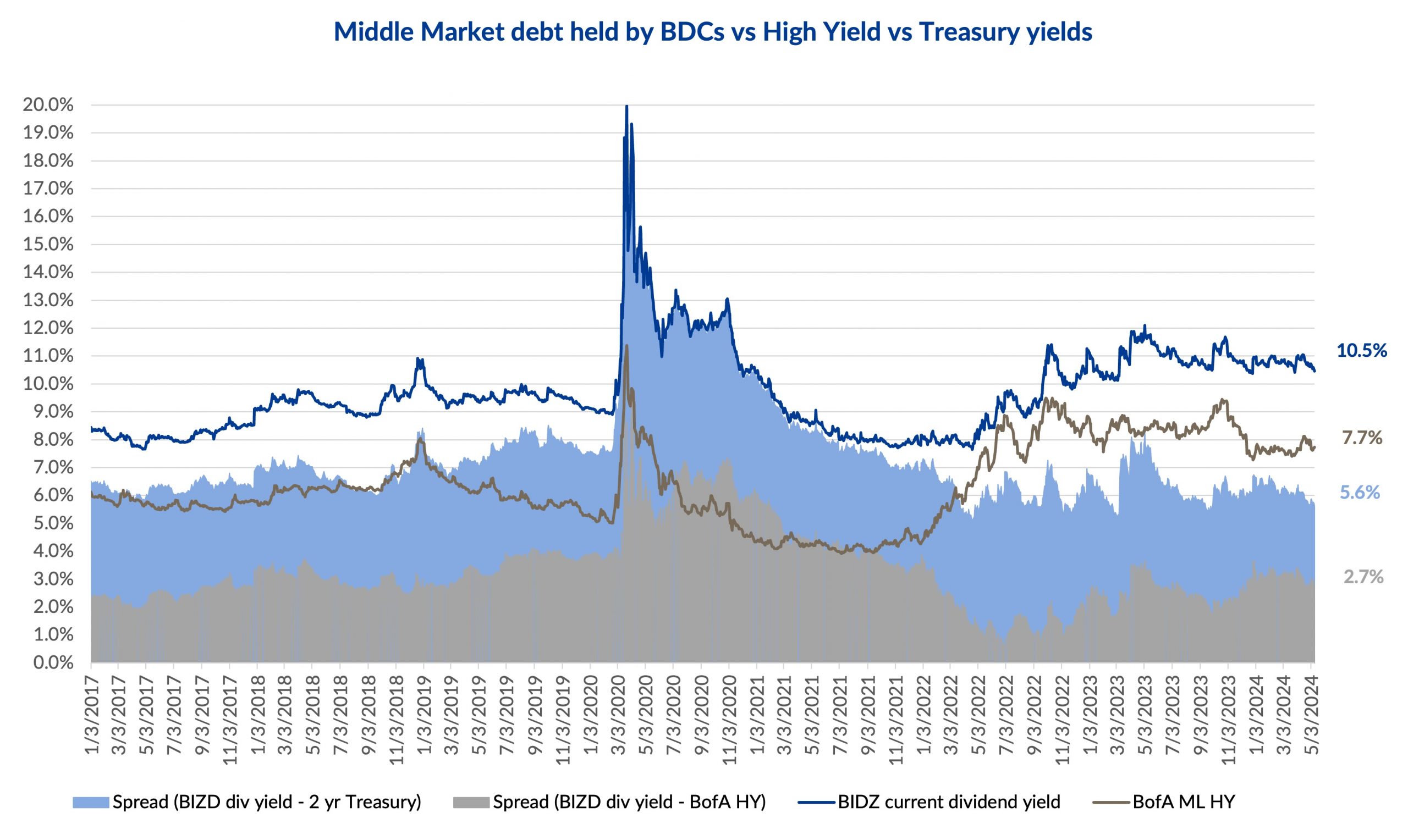

Middle Market & Private Credit – 5/13/2024

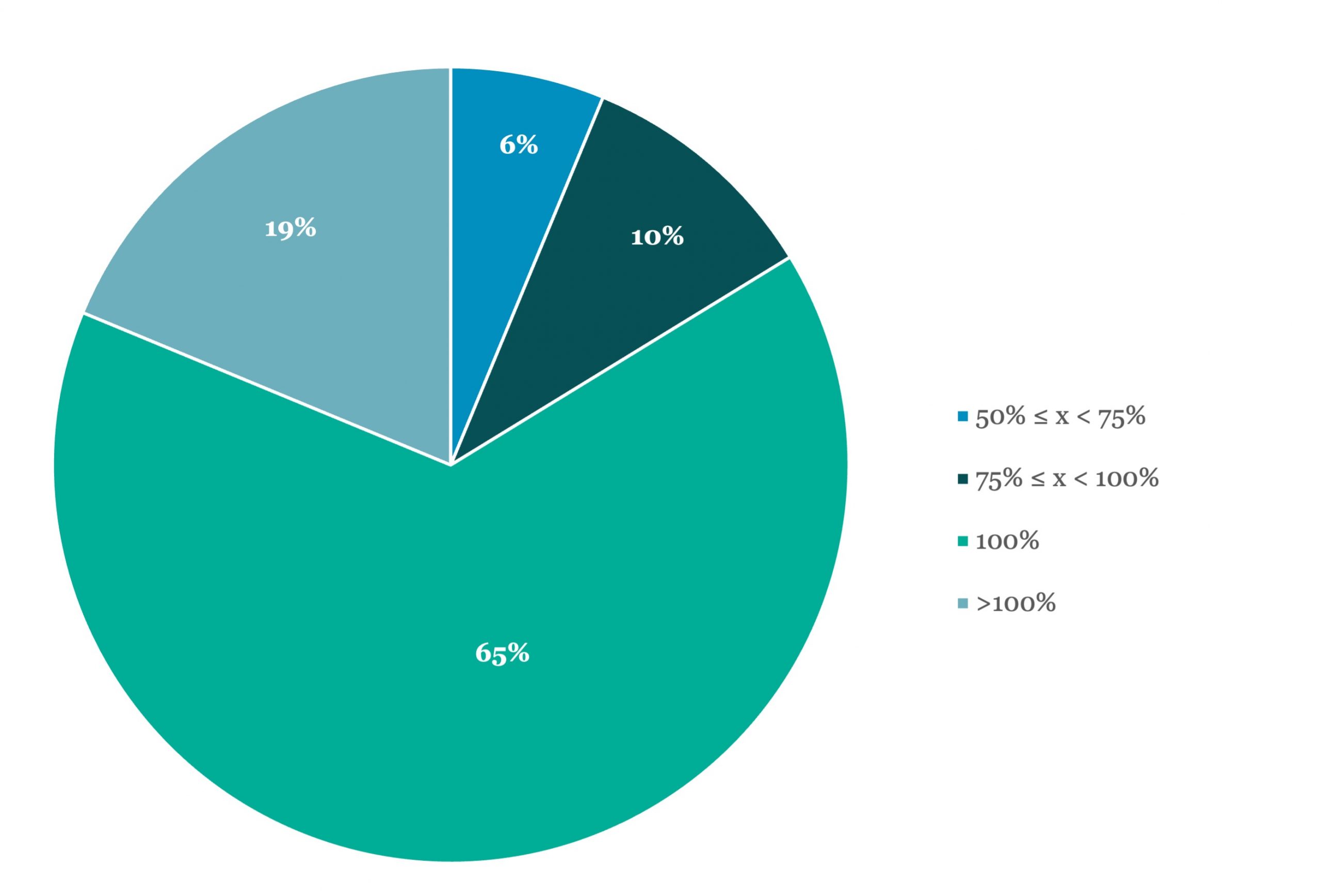

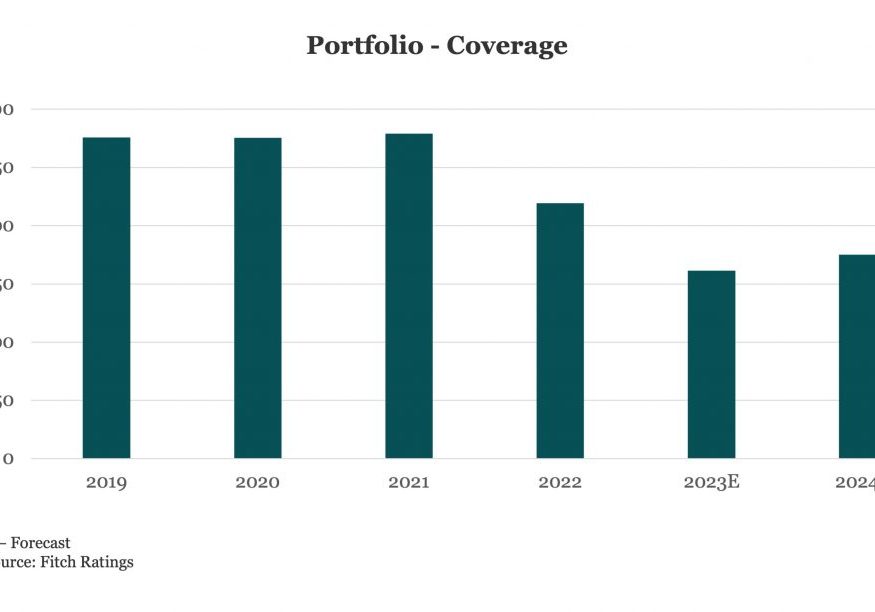

Fitch’s Privately Monitored Middle Market Portfolio Overview, 1Q24 Download FitchRating’s Report here. In the charts above, Fitch presents aggregate data for MM companies, defined as in the area of $500 million of debt or $100 million of EBITDA or below, that it privately rates for asset managers…. Login to Read More...

View ArticleLeveraged Loan Insight & Analysis – 5/13/2024

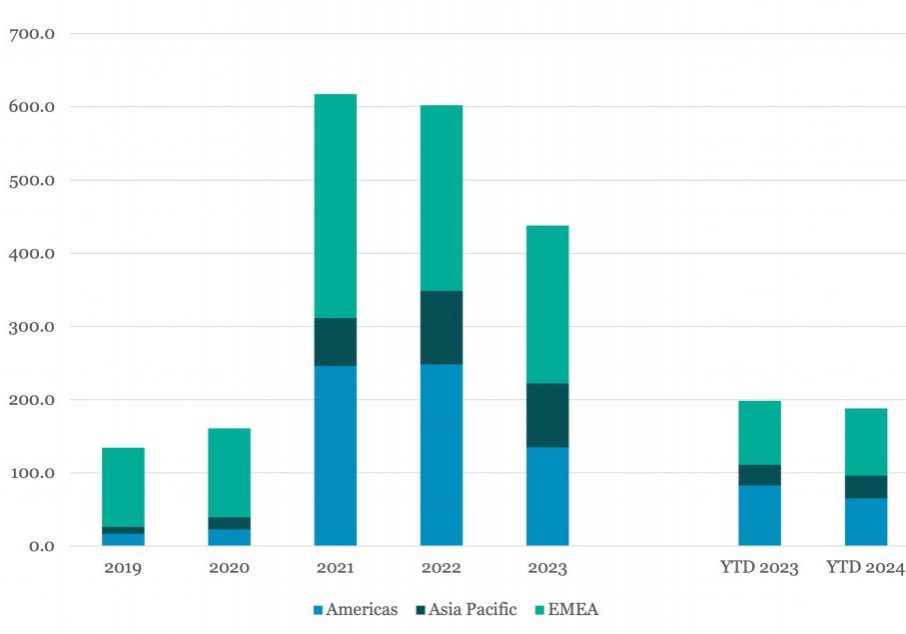

Global SLL issuance is down 5% year over year at less than US$190bn Having reached a high of over US$617bn globally in 2021, sustainable loan issuance has tapered off in the last two years…. Login to Read More...

View ArticlePDI Picks – 5/13/2024

Europe’s hot topics This week, we reflect on a few of the talking points from PDI’s recent Europe Summit 2024 in London. Are favoured sectors still good value?One panellist said the gradual retreat of covid brought with it the end of the honeymoon period for technology and life sciences, two sectors that had previously exploded…

View ArticleLeveraged Loan Insight & Analysis – 5/8/2024

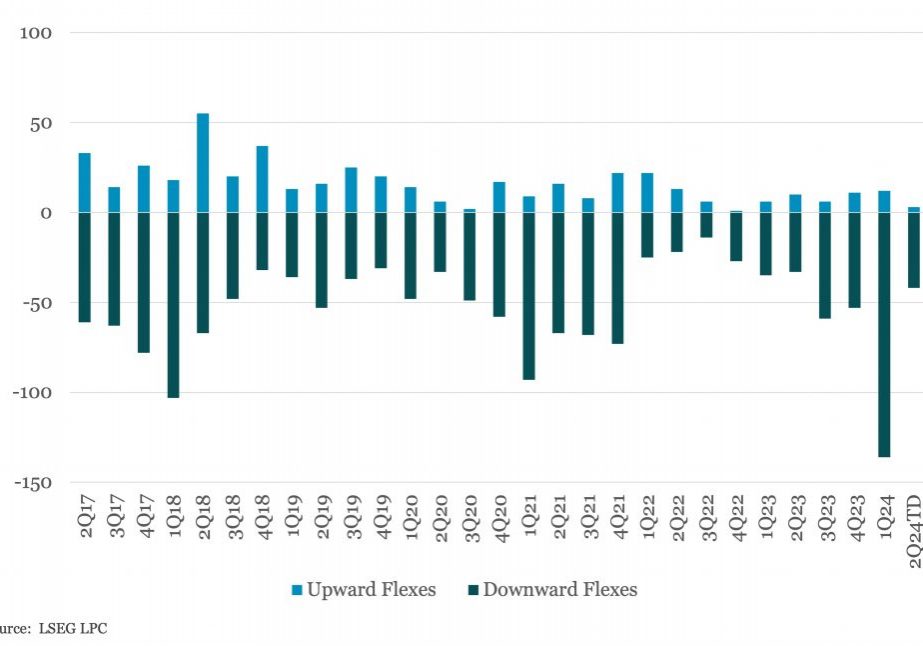

Daily Analytic: US downward price flexes continue in 2Q24 After a record first quarter, the number of downward price flexes on first-lien institutional loans continues to be strong through early May…. Login to Read More...

View ArticlePrivate Debt Intelligence – 5/6/2024

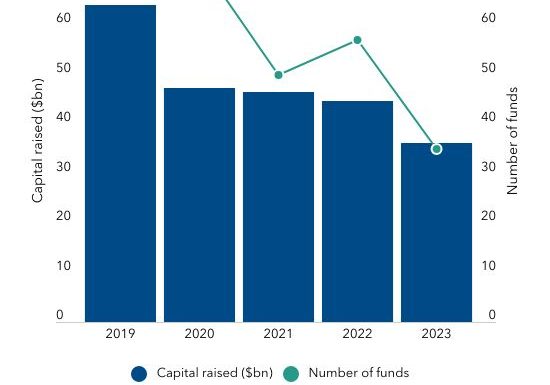

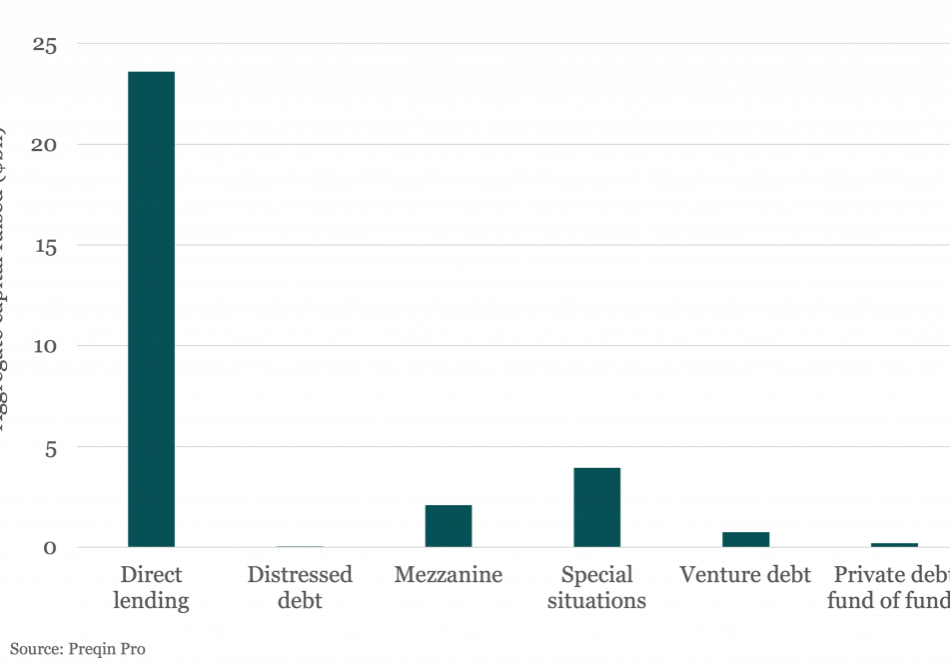

Direct lending dominates first quarter fundraising Demand for direct lending strategies has increased consistently over the past 15 years, as private credit has evolved from niche products such as mezzanine and distressed debt to a mainstream source of finance for deals and companies…. Login to Read More...

View ArticleBeginning in July 2022 The Lead Left published a series of articles on credit market. This report consolidates those articles.

Cov-lite trends Inflation & rising interest rates – LIBOR to SOFR transition Mega-tranche uni trend ESG takes center stage Login to view interactive report and download PDF version. … Login to Read More...

Beginning in September 2021 The Lead Left published a series of articles on supply chain. This report consolidates those articles.