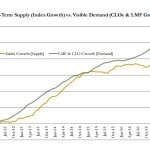

The confusion around differences between public and private credit dynamics has been compounded by the rapid growth of the illiquid asset class. The middle market was infrequently on investors’ radars until it began to rival broadly syndicated loans and high-yield bonds in size.

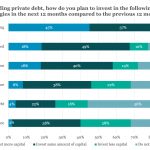

At $1.5 trillion, private credit has caught up with both, and by some estimates will more than double in the next several years. That kind of popularity attracts an increasing number of investors (“Wow, what’s this?”) historically in large-cap, liquid strategies. Such a raised profile also has raised eyebrows with regulators and the media (“Wow, should we be worried?”)…

▶︎ Read November 27 2023 Newsletter: here

(Any “forward-looking” information may include, among other things, projections, forecasts, estimates of market returns, and proposed or expected portfolio composition Past performance is no guarantee of future results. Investing involves risk; principal loss is possible.)