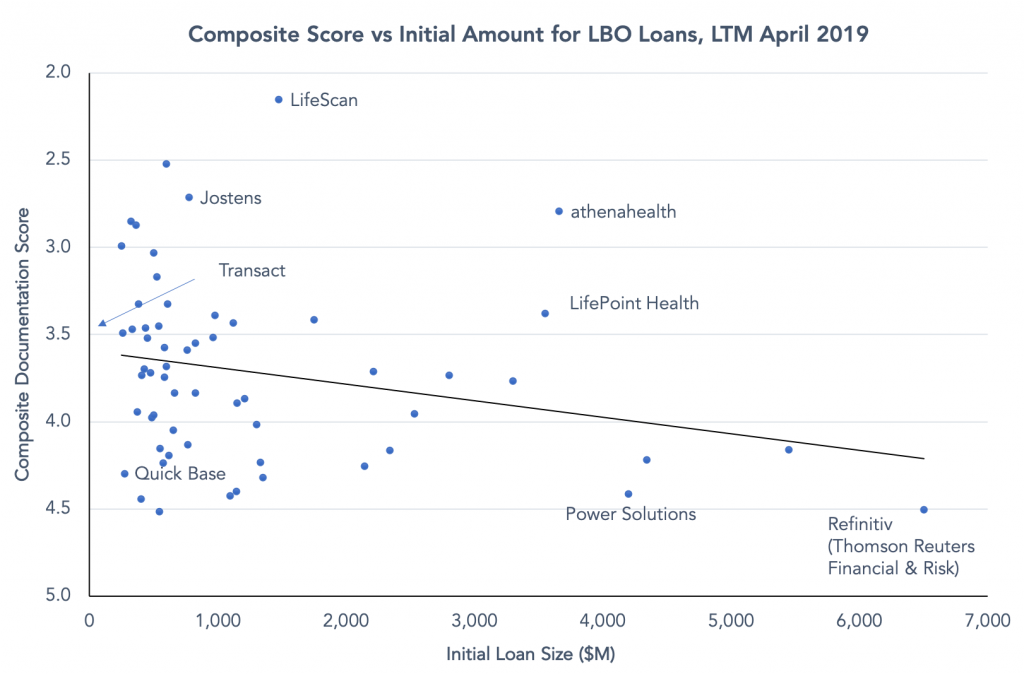

Broadening our lens, a simple scatter plot of LBO loans over the past year for which Covenant Review has analyzed final terms or updated preliminary terms illustrates the fact that higher-scoring loans tend to be concentrated at the smaller-end of the market. Size, however, is not destiny when it comes to covenant terms. There are many other factors at play, of course, including sponsorship, the strength of the overall credit story and market conditions.

Take the $260 million Quick Base loan, which benefited from the backing of big-boy sponsor Vista. The loan cleared in February with a Documentation Score similar to such aggressively structured jumbo loans as Refinitiv and Power Solutions. At the same time, the $2.6 billion loan for Athena Healthcare’s LBO by Veritas ran into lender resistance that pushed terms tighter and resulted in a far more protective Documentation Score on Covenant Review’s scale.

What is Documentation Score?

Covenant Review’s Documentation Scores express the strength of an instrument’s covenant protections on a number scale running from 1 (strongest) to 5 (weakest) with pluses and minus to between 1 and 5 to provide more context to the scores. Documentation Scores are derived from Covenant Review’s market-leading analysis of loan documents by our staff of experienced leveraged finance attorneys. For each loan, Covenant Review will provide one overarching Composite Score that is based on the following three sub-scores: (1) Collateral Protection, (2) Default Protection and (3) Lender’s Repricing Optionality. Covenant Review applies a proprietary weighing method to a series of qualitative, empirical, and judgment factors to produce each composite score and sub score.

Contact: Steven Miller