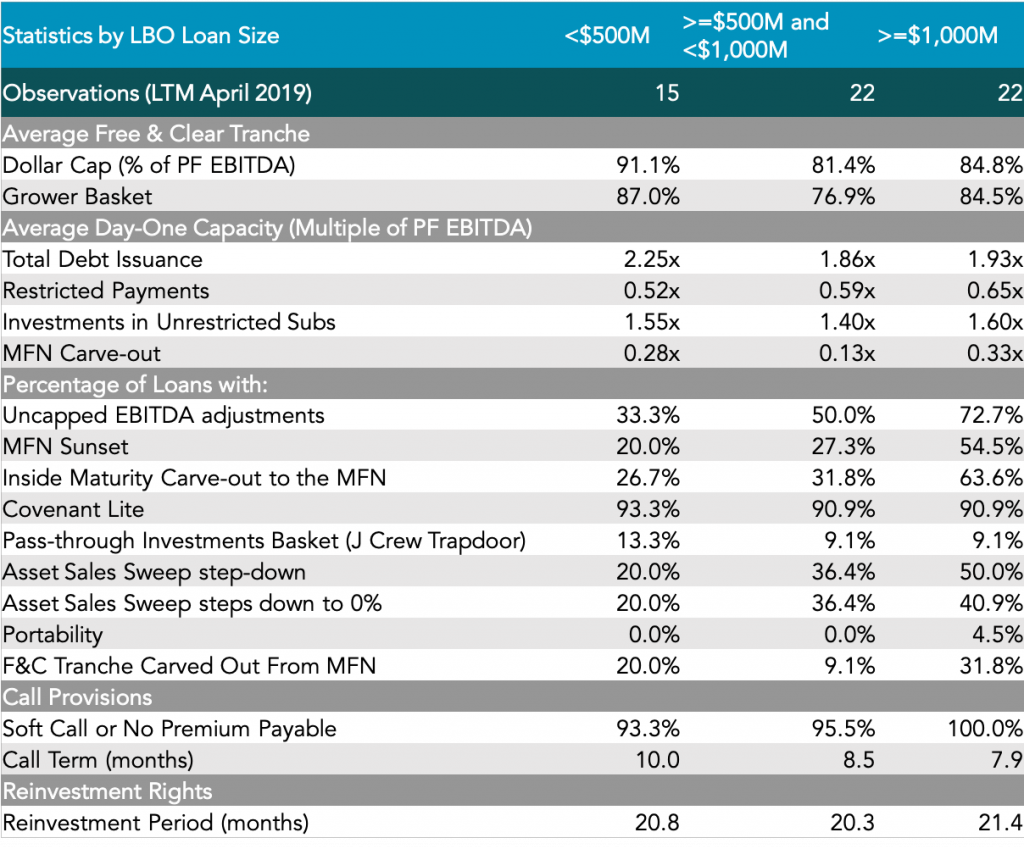

Underlying the better Documentation Scores among smaller leveraged loans is a series of tighter covenant terms, as we run down in the tables above.

What is Documentation Score?

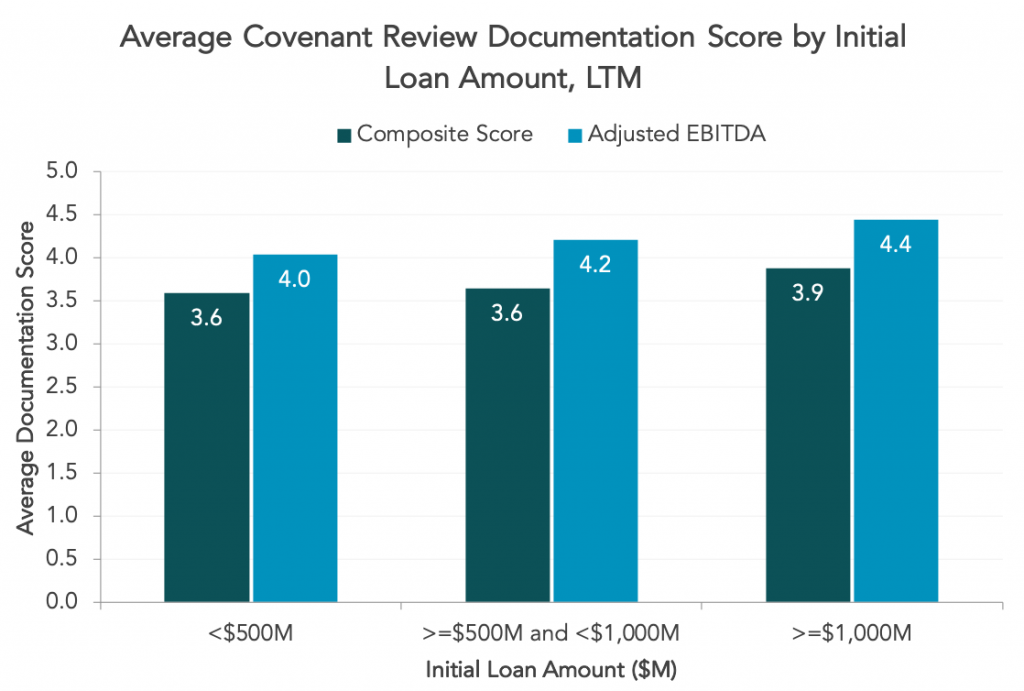

Covenant Review’s Documentation Scores express the strength of an instrument’s covenant protections on a number scale running from 1 (strongest) to 5 (weakest) with pluses and minus to between 1 and 5 to provide more context to the scores. Documentation Scores are derived from Covenant Review’s market-leading analysis of loan documents by our staff of experienced leveraged finance attorneys. For each loan, Covenant Review will provide one overarching Composite Score that is based on the following three sub-scores: (1) Collateral Protection, (2) Default Protection and (3) Lender’s Repricing Optionality. Covenant Review applies a proprietary weighing method to a series of qualitative, empirical, and judgment factors to produce each composite score and sub score.

Contact: Steven Miller